How to check if your pension fund is performing well enough

Finding out how your pension is performing only takes a few minutes, but it can lead to you having a lot more money later in life.

I came onto the podcast (video above) when I explained the high-level process but I wanted to make it easy for you, so I’m going to lay it all out clearly below.

Step-by-step guide

1. Find out who your pension is with (most people don’t know, so don't feel bad if that's you). The easiest way is to ask your HR department, or dig out the pension handbook you were probably given when you signed your contract (what are the chances that's still lying around!)

This is also a good moment to look up any past pensions you’ve paid into and have perhaps forgotten about, which you can do from the government site here.

2. Next, you’ll need the name of your pension fund (or funds). It will be on your pension statement, but if you can’t find that, just ring up your pension provider and ask.

3. Google ‘Trustnet + your fund name’ because it's the easiest way to find your fund's Trustnet page rather than searching on Trustnet. I've done it with a popular Scottish Widows fund below.

4. Click on the top hit. The Trustnet page for the fund will usually have a bit of summary text at the top. Scroll down and you’ll find a series of charts about its performance.

5. Check out the first chart on the page, labelled ‘Cumulative Performance’. You’ll see it has two different coloured lines. The turquoise line is normally your pension fund, whilst the other lime green coloured line is the benchmark (they could’ve picked better colours!) In the example below, the benchmark is labelled ‘PN Specialist’, but yours will probably be something else – they differ with each pension.

You now have a sense of how your pension fund is performing against a benchmark. In the example above, the fund looks like it's doing pretty well - but is that the right benchmark to use?

I’d be wary of putting all your trust in sector benchmarks like this because they often don't reflect the true performance of your kind of fund. There are often better benchmarks out there so it’s best to do your own checks, which I’ll explain below.

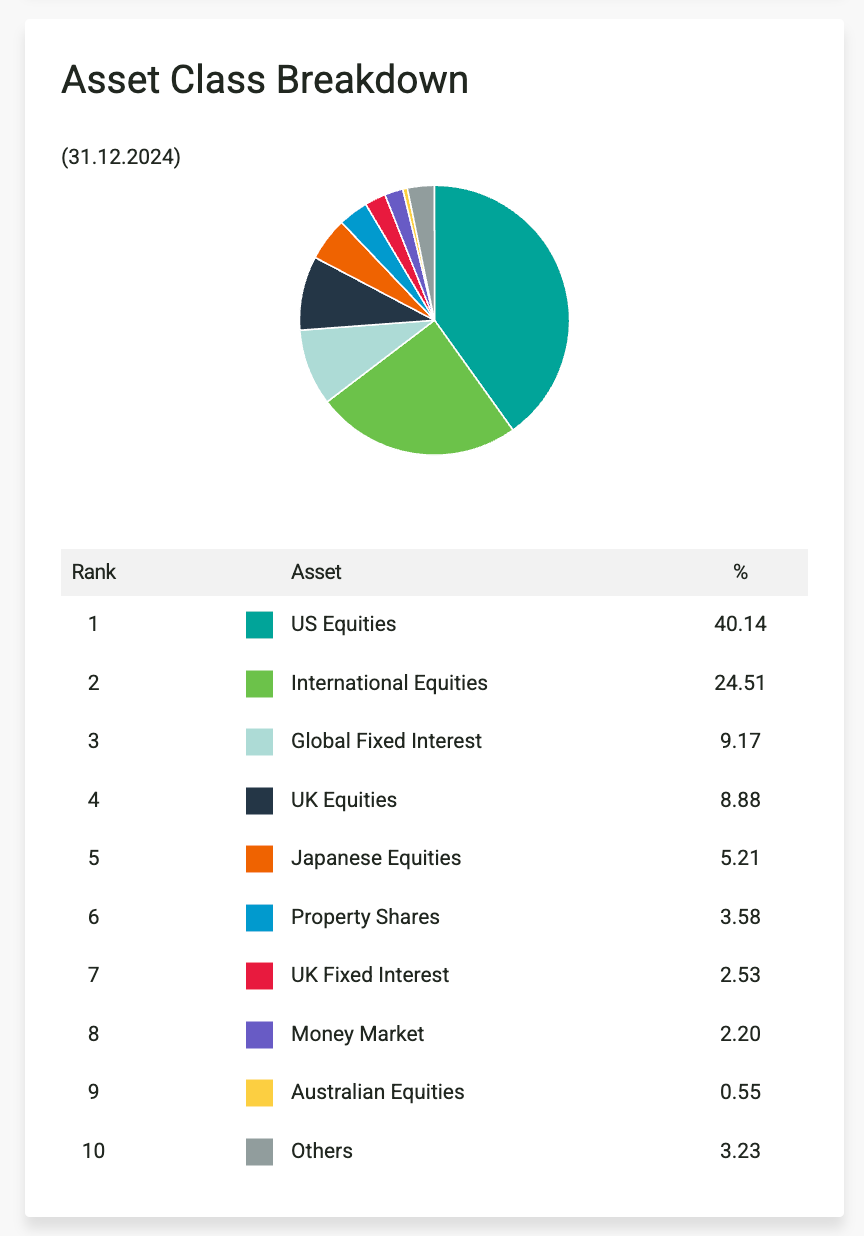

5. Keep scrolling down the Trustnet page for your fund. At the bottom, you’ll find a pie chart with a full breakdown, e.g. of bonds and equities. If you can’t find a breakdown there then get in touch with your provider. They’ll email you the fund fact sheet, or help you find it on their website.

6. Now that you've got the breakdown of your fund, add up the percentages of equities. You can see our Scottish Widows example comes out at about 80% equities.

7. Next we need to find a more reliable market comparison than the benchmark on Trustnet. We’re going to use Vanguard because they offer a range of ‘Life Strategy’ funds with various ratios of equities to bonds to suit different life stages (more on that in a moment).

Repeat the Google search above to find a Vanguard Life Strategy fund with a similar ratio of equities to bonds to your pension, e.g. if your pension fund has 80% equities, find the 80% Vanguard fund.

Now that you can see your fund next to a similar Vanguard one, you can look at their performance, side-by-side. Which has performed better?

8. Of course, besides performance, there will be charges to think about too. Check the Vanguard charges, and compare them with the costs of your pension to get a sense of whether your fund is well priced. It’s always best to get the charges from your provider directly, as different fund categories have different charging structures.

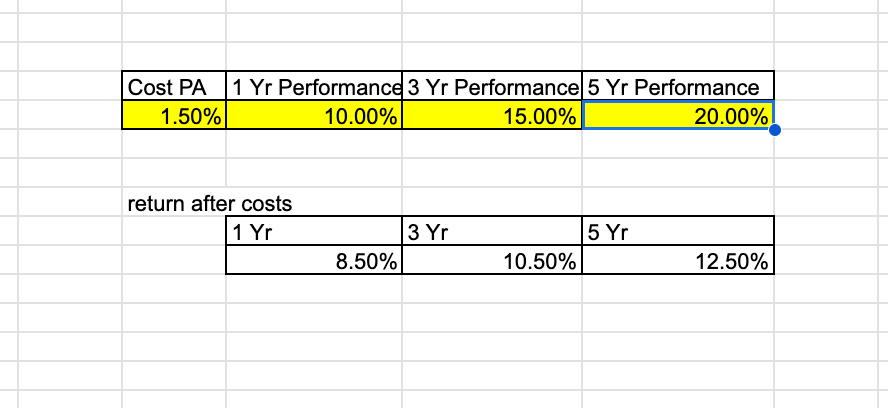

9. If this process reveals a fund that seems to perform better than your one, but is also more expensive, then you’ll need to figure out whether the extra performance justifies the extra cost. I have created a simple price adjusted return calculator to help you work this out. Please click here, then make your own copy and fill in the yellow cells with the relevant numbers from the funds you’re looking at.

10. Before you switch to a higher performing version of a similar kind of fund (e.g. 80% equities), it’s worth considering what balance of equities and bonds suits you.

Broadly speaking, workplace pensions take a ‘one size fits all’ approach. These default funds typically include a meaningful proportion of lower risk assets like bonds, which tend to deliver more modest long-term returns than equities. So, if you’re relatively young (say, under 45) and not able to touch your pension for a long time, you may want to consider a higher proportion of equities.

This is a big question, so for more help, check out this wider article on how to get the most from your pension.

Please note:

Not all funds are on Trustnet – some employers have their own bespoke funds. If you can’t find the breakdown, get in touch with the provider to request the fund fact sheet.

To make sure you’re not making a big mistake, have a look at ‘Spot the Dog’ on BestInvest - a free guide which exposes badly performing funds. It's worth scanning in case your pension fund has made the list 😱

Recap

Use a site like Trustnet to:

See how your fund compares to the supposed benchmark, but more importantly

Find your pension fund’s asset allocation, e.g. 80% equities

Compare your pension fund to a similar fund with Vanguard (or other tracker funds) to see how it measures up.

To make sure you’re getting the best value, do a price adjusted return using my simple spreadsheet.

Remember your pension providers work for you...

Best of luck!

This is not financial advice. The reason it’s not financial advice is because it’s not tailored to you. We are here to talk about the principles of building wealth but if you want personalised help, it’s worth speaking to a financial advisor, like Lisa. As with everything financial, please do your own research. We really encourage that because no one cares more about your money than you and if you learn the basics then it’s life-changing.